- Timeline of a DB transfer

- Public sector schemes

The right pension

The ability to transfer between registered pension schemes has been a feature of the UK pension regime since the 1980s, allowing members to move their pension savings for a variety of reasons. But it has become increasingly important since the advent of DC 'pension freedom' in 2015.

However, defined benefit (DB) pension schemes offer valuable guarantees and the Regulator's view is that transferring away is unlikely to be beneficial for the majority of scheme members.

But for some, typically wealthier, individuals who aren't reliant on the guaranteed income for life provided by a DB pension, the DC 'pension freedoms' could provide a route to a more flexible retirement and increased death benefit options that better meet their needs.

Income drawdown under DC schemes can give the member greater flexibility and tax efficiency in how they take their pension savings. And the changes in how death benefits are taxed and who can benefit mean that the option of beneficiary's drawdown gives the ability to pass pension wealth down through the generations - or even to friends - very tax-efficiently outside the estate.

DB schemes are unlikely to provide the ability to vary retirement income and pension death benefits are limited to a taxable income for dependants only. An individual with no spouse/civil partner and only adult children could find that all their DB pension rights are extinguished on death.

However, moving from the security of DB to access DC flexibility normally brings a significant increase in risk for the individual - so it's not a decision to be taken lightly. It also comes at the cost of limiting future funding, as accessing income flexibly under a DC scheme invokes the 'money purchase annual allowance' (MPAA), which restricts DC contributions to no more than £10,000 a year (with no carry forward).

Being in the right pension for the member's needs is crucial. Advice is paramount to achieving the right outcome. And where the DB benefits have a transfer value of more than £30,000 advice is mandatory.

The right to a DB transfer value

Members of occupational DB pension schemes have a statutory right to a transfer value, known as a cash equivalent transfer value (CETV), as long as:

- they've stopped accruing DB benefits within the scheme (even if they are still an active member on a DC basis) and

- are not within one year of the scheme's normal retirement age.

The member can request a guaranteed transfer value once every 12 months. The trustees of the scheme can grant more frequent requests if they wish and even provide a CETV when a member doesn't have a statutory right to one.

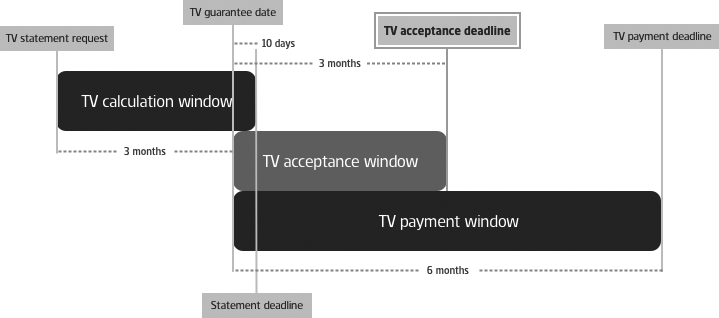

Timeline of a DB transfer

- Request for a transfer value - If the value of the member's DB rights (or any other safeguarded benefits) is over £30,000, the member must obtain financial advice before they can proceed with a transfer. Where this advice requirement applies, the DB trustees must tell the member within one month of receiving the request for a transfer value statement

- Guarantee date - The guarantee date, on which the CETV is calculated, must be within three months of the original request. This is the date which sets the start of the guarantee period (or 'acceptance window')

- Statement of entitlement - The trustees must provide the member with their guaranteed CETV 'statement of entitlement' within 10 days of the guarantee date. This means that the trustees have a maximum of three months and 10 days to calculate and provide the member with the CETV.

- Acceptance deadline - The member has three months from the guarantee date to confirm they want to proceed with the transfer - which means they may have little more than two and a half months to act by the time they receive their guaranteed CETV statement. They also must confirm details of the receiving scheme and complete the paperwork required by the DB scheme within this deadline.

- Proof of advice - Where the advice requirement applies, the member must provide the trustees with written confirmation from the authorised adviser that advice has been given in relation to the transfer, within three months of receiving their statement of entitlement. They don't need to say what the advice was - just provide evidence that appropriate advice has been obtained.

- Transfer completion deadline - Assuming everything is in order, the trustees must transfer the benefits within six months of the guarantee date.

Public sector schemes

Even though a member may have a statutory transfer right, unfunded public sector pension schemes (for example, the NHS Pension Scheme) cannot transfer benefits to a DC scheme capable of providing flexible benefits, such as income drawdown.

But transfers are allowed to DC schemes that don't provide flexible benefits. This allows members to transfer to buy conventional annuities, which could help those who are unlikely to get good value for money from their DB promise - for example, those in poor health or single people who have no need for a survivor's pension on their death.

Funded public schemes (for example, the Universities Superannuation Scheme) will allow transfers to DC schemes that offer income flexibility.

Pension scams prevention

Regulations were introduced on 30 November 2021 to help protect members from pension scammers. The new rules allow pension trustees and scheme managers to refuse transfers where there's a suspicion of scam activity. When processing transfers, they’re encouraged to pass through several steps of due diligence, which includes flagging potential problem transfers as either ‘amber’ or ‘red’ flags.

- If the transferring scheme raises a red flag, the transfer can be stopped

- If an amber flag is raised, the member will have to take specific scam guidance from the Money and Pensions Service (MaPS) before the transfer can go ahead

The following types of schemes are deemed to be ‘safe destinations’ and are effectively exempt from these new rules:

- public sector schemes

- authorised master trusts schemes

- authorised collective DC schemes

Safeguarded benefits and the advice requirement

'Safeguarded benefits' are certain pension benefits that provide security or valuable guarantees that can be lost if the member transfers or converts to get flexible benefits. Defined benefits fall into this category.

To make sure individuals are fully aware of what they could be giving up, they must get 'appropriate independent advice' from an FCA authorised adviser before they can proceed with a transfer - unless the value of the safeguarded benefits is £30,000 or less.

Some schemes have different categories of benefit, some of which are safeguarded benefits and others which aren't - e.g. an occupational scheme with both defined benefits and defined contribution funds. With such schemes it may be possible to transfer the non-safeguarded (DC) benefits without having to get financial advice - regardless of the value of the DB rights.

Confirmation that advice has been given

Before safeguarded benefits worth more than £30,000 can be transferred or converted, the individual must confirm to the trustees or scheme administrator of the transferring DB scheme that they've received 'appropriate independent advice' on the transaction.

This must be in the form of a written statement from the adviser confirming:

- advice has been given on the proposed transaction

- they have the appropriate permissions to carry out the transaction

- their firm's FCA reference number for the purposes of being authorised to carry out such transactions

- the member or beneficiary's name plus the name of the scheme which holds the safeguarded benefits to which the advice applies

The adviser must provide this statement, regardless of whether they recommended a transfer or advised against it. Remember, the statement just confirms that the member has received advice on the matter from a suitably qualified and authorised professional - not what that advice was. Giving the statement doesn't imply the adviser endorses the member's course of action.

This adviser's statement must be given to the trustees or scheme administrator within three months of the individual receiving their CETV statement of entitlement.

Calculation of transfer values

The pension scheme trustees are responsible for deciding how transfer values should be calculated, based on guidance from the scheme actuary - particularly around appropriate assumptions about the future course of events affecting the scheme and the member's benefits.

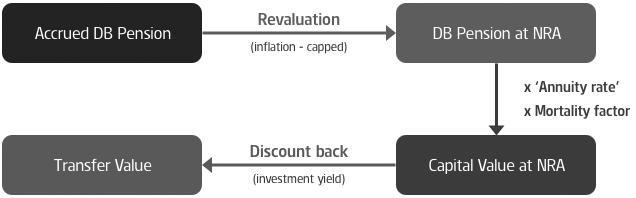

There are five broad steps in the calculation:

- Calculate the accrued pension

- Revalue to normal pension age (to establish the expected pension at normal pension age (NPA))

- Multiply by something akin to an 'annuity rate' (to establish the cash value/reserve needed at NPA to provide the expected pension income)

- Apply a mortality factor (to reflect the chance of surviving to NPA to receive the pension)

- Discount back to the current date (to establish the current cash equivalent transfer value)

In other words, the CETV is the estimated amount that would need to be invested now, based on assumed investment returns on the DB scheme assets between now and NPA, to deliver the estimated reserve needed at NPA to provide the expected DB pension income.

Although this broad approach to calculating DB transfer values is fairly standard, trustees have discretion over the assumptions used (to reflect the particular circumstances of their scheme) - so different schemes could offer very different transfer values for the same amount of DB pension.

Assumptions

The main assumptions made in DB transfer value calculations tie in with steps 2 to 5 above:

- Inflation - to revalue the accrued DB pension to the scheme's NPA and estimate how much it will increase by each year once in payment

- Gilt yields - to estimate the cash value of the accrued DB pension at NPA, something akin to annuity rates are used. Annuity rates are primarily based on 15 year gilt yields

- Mortality - to reflect the chance of surviving to NPA and to estimate how long the pension will be paid. Mortality assumptions may be influenced by the industry in which the employer operates and/or by geographical location

- Investment returns - to establish an appropriate discount rate for calculating the current transfer value, by estimating returns on the scheme assets between now and NPA.

There's a choice of two methods available for calculating transfer values:

- The best estimate of the expected cost of providing the member's benefits (as above) and

- An alternative, where the trustees want to pay a transfer value above the minimum amount

Further guidance on DB transfer values is available on the Pensions Regulator's website.

Reduced transfer value

It's possible, in certain circumstances, for the trustees of DB schemes to offer reduced transfer values less than the 'initial cash equivalent' under the best estimate method.

The funding situation of the scheme is one of the situations that allow a reduction. But cash equivalents may only be reduced for this reason after obtaining an insufficiency report. This is an assessment by the actuary of the funding of the scheme using the transfer value assumptions. Any reductions to transfer values taking scheme funding into account must not be more than the maximum reduction identified in the insufficiency report. And, if a transfer value is reduced on grounds of underfunding, the trustees must tell the member the extent of the reduction applied and when they expect to be able to pay a full transfer value.

Although trustees have the power to reduce CETVs to allow for low funding levels, there's no obligation for them to do so. The decision may hinge on the trustees' view of the strength of the employer covenant and the length of the scheme's funding recovery plan.

Partial transfers

A binary 'all or nothing' transfer option doesn't always support the best member outcomes. While most people with a DB pension will be best advised to stick with it, a partial transfer could be the solution for those caught between needing some of the security of their DB promise and some of the income flexibility and estate planning opportunities offered by modern DC pensions.

Many schemes don't give the option of a partial DB transfer - there's currently no statutory right to a partial transfer of DB rights - but the number of schemes now offering them is on the rise. The barriers holding some DB schemes back from introducing a partial transfer option are the perceived complexity and cost. Legal fees to amend the scheme documents, actuarial fees to develop a transfer basis and the costs of implementing the necessary administrative processes can all be off-putting. But these are all achievable and the payback for all concerned could be worth it.

- Member - For members who want some guaranteed income, but not as much as their full DB entitlement, a partial transfer may be the best fit for their needs. It can provide the guaranteed income they need, plus flexibility with the balance of their accumulated DB wealth.

- Employer - Growing numbers of employers have realised that allowing partial transfers helps get DB liabilities off their balance sheet efficiently. If they stick with an 'all or nothing' stance, more liabilities may stay on their books.

- Trustees - Every transfer paid normally improves their scheme's actuarial funding position – leaving remaining members more secure. It's rare for a transfer value to be higher than the actuarial 'technical provisions' they have to reserve for to back the DB promise.

However, partial transfers are possible - to a certain extent - for members of mixed benefit schemes. They have a statutory right to transfer their DC rights and leave the DB pension behind (or vice versa).

When advising on a potential DB to DC transfer, advisers should always ask whether a partial transfer is available - so their advice can reflect all the options on the table.

Transferring while in poor health - IHT

HMRC take the view that transferring pension benefits from one scheme to another is a transfer of value for IHT. This is regardless of whether the pension benefits in both the original and the new scheme are outside the estate for IHT.

This will only potentially be an issue if the client was in poor health at the time of transfer. A Court of Appeal decision in the ‘Staveley Case’ has called into question HMRCs approach to transfers in ill-health.

HMRC haven’t updated their guidance following the decision which leaves an amount of uncertainty on the IHT position on transfers where a clients suspect they may not survive for more than two years from the date of transfer.

To avoid this uncertainty, it makes sense for any client considering a pension transfer to act before their health starts to decline.

More details on pension transfers and IHT are contained in our technical guide 'Pensions and IHT'.

Note - There's no IHT reporting to do at the time of a pension transfer. The executors only need to report it to HMRC (on form IHT409) if the individual dies within two years of the transfer.

Transfers involving protected tax-free cash or a low pension age

There's an additional complication when transferring benefits which have:

- an entitlement to more than 25% tax-free cash under 'scheme-specific tax-free lump sum' protection or

- a protected low pension age

Unless the transfer is part of a 'block transfer', the protection will normally be lost. However, protection can sometimes also remain on certain individual transfers or on scheme wind-up:

-

Block transfers: A transfer is considered to be a 'block transfer' if two or more members of a pension scheme transfer to the same receiving scheme at the same time. There's no requirement for all members involved to have something to protect.

The transfer must represent the members' total rights under the transferring scheme and can't be split across more than one receiving scheme.

If any member involved in a block transfer has been a member of the receiving scheme for more than 12 months when the transfer is made, their transitional protection will normally* be lost - this includes all previous periods of membership of the scheme, even if the benefits have since been transferred out. But the block transfer will still be effective for the other member(s).

Of course, losing the protection may not be much of a concern if the level of tax-free cash is only marginally greater than 25%, or if benefits are unlikely to be taken before the normal minimum pension age - or perhaps if the benefits gained from transferring outweigh the loss of protection.

Our guides Scheme-specific tax-free cash protection and Pension age give more information on these protections.

Transfers for those with fixed or enhanced protection

Since 6 April 2023, fixed or enhanced protection can be lost on transfer in only limited circumstances - this depends on when the protection was registered:

- Registered by 15 March 2023 - if protection was registered by 15 March 2023 (and not invalidated it before 6 April 2023) these individuals are able to freely transfer their pension benefits without fear of breaking this protection.

- Registered after 15 March 2023 - if the protection was registered after 15 March 2023, or if invalided before 6 April 2023, then the pre-6 April 2023 transfer rules will apply. Enhanced protection or any of the fixed protections will normally be maintained following a pension transfer, provided the transfer is a 'permitted transfer'. A DB to DC transfer is only a permitted transfer if the transfer value represents the actuarial value of the benefits being transferred. No enhancements can be included. This means that accepting an enhanced transfer value will normally result in enhanced or fixed protection being lost.

Issued by a member of abrdn group, which comprises abrdn plc and its subsidiaries.

Any links to websites, other than those belonging to the abrdn group, are provided for general information purposes only. We accept no responsibility for the content of these websites, nor do we guarantee their availability.

Any reference to legislation and tax is based on abrdn’s understanding of United Kingdom law and HM Revenue & Customs practice at the date of production. These may be subject to change in the future. Tax rates and reliefs may be altered. The value of tax reliefs to the investor depends on their financial circumstances. No guarantees are given regarding the effectiveness of any arrangements entered into on the basis of these comments.

This website describes products and services provided by subsidiaries of abrdn group.

Full product and service provider details are described on the legal information.

abrdn plc is registered in Scotland (SC286832) at 1 George Street, Edinburgh, EH2 2LL

Standard Life Savings Limited is registered in Scotland (SC180203) at 1 George Street, Edinburgh, EH2 2LL.

Standard Life Savings Limited is authorised and regulated by the Financial Conduct Authority.

© 2024 abrdn plc. All rights reserved.